Best Practices Articles

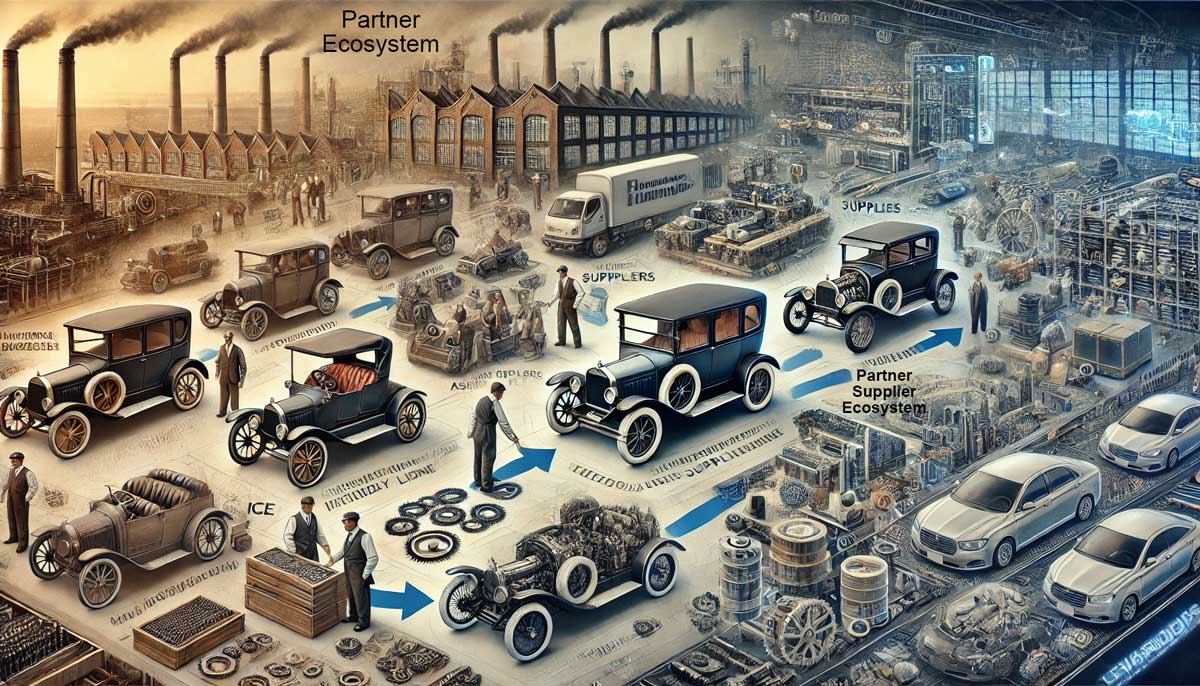

The Evolution of the Automotive Partner Ecosystem

Part 1

The automotive industry’s evolution is deeply intertwined with the development of its partner ecosystem, a complex web of suppliers, manufacturers, and system integrators that has shaped the industry’s trajectory. This part of the article delves into the historical foundations of the automotive partner ecosystem, tracing its origins from the early days of the combustion engine to the globalized supply chains of the late 20th century.

The Birth of the Automotive Partner Ecosystem

The origins of the automotive partner ecosystem can be traced back to the late 19th century with the advent of the Internal Combustion Engine (ICE). Early automobiles were relatively simple machines compared to today’s standards, but even these early vehicles required a network of specialized suppliers. Pioneers like Karl Benz and Gottlieb Daimler, credited with inventing the first practical gas-powered vehicles, relied on various artisans and suppliers to provide components such as engines, wheels, and chassis. These early collaborations laid the groundwork for developing complex supply networks in the following decades.

As the automobile began to gain popularity in the early 20th century, particularly in Europe and the United States, the demand for vehicles spurred the growth of a more formalized automotive partner ecosystem. Automakers like Ford, General Motors, and Chrysler emerged as industrial powerhouses but did not operate in isolation. These companies depended on a vast network of suppliers to provide the thousands of components needed to assemble a car. The need for reliable and high-quality parts led to the emergence of specialized suppliers, which were often located near the automakers’ factories to facilitate efficient production.

The Assembly Line and the Expansion of the Supply Chain

A key milestone in the evolution of the automotive partner ecosystem was the introduction of the assembly line by Henry Ford in 1913. The assembly line revolutionized automobile manufacturing by allowing cars to be produced on a massive scale. This innovation drastically reduced the time and cost of production, making cars more affordable and accessible to the general public.

However, the success of the assembly line also depended on the efficiency and reliability of the supply chain. Ford’s Model T, the first car to be mass-produced, required a steady and precise flow of parts to keep the assembly line moving. This need for coordination and synchronization between the automaker and its suppliers led to more structured and formalized supply chain relationships. Suppliers were categorized based on their proximity to the final assembly process, with some providing raw materials like steel and rubber, while others supplied finished components like engines and transmissions.

This period also saw the rise of vertically integrated companies, where automakers sought to control as much of the production process as possible. Ford, for example, owned rubber plantations in South America to supply its tire factories, steel mills, and glassworks. This vertical integration was a strategy to reduce dependency on external suppliers and to control costs and quality more effectively.

The Rise of Tiered Suppliers and System Integrators

As the automotive industry continued to grow throughout the 20th century, the complexity of vehicles increased, leading to the development of a more layered supply chain structure. By the mid-20th century, tiered suppliers had become a defining feature of the automotive partner ecosystem.

Tier 1 suppliers directly provided complete systems or major components to Original Equipment Manufacturers (OEMs) in this system. These suppliers often specialize in powertrain components, electronics, or braking systems. Tier 1 suppliers were crucial automakers' partners, as they were responsible for developing, testing, and integrating complex systems into the vehicle.

Tier 2 and Tier 3 suppliers, on the other hand, provided more specific parts and raw materials, which were often incorporated into the larger systems produced by Tier 1 suppliers. This tiered structure allowed for greater specialization and efficiency within the supply chain. For example, a Tier 2 supplier might produce a specific type of sensor integrated into a larger Electronic Control Unit (ECU) provided by a Tier 1 supplier.

System integrators, particularly among Tier 1 suppliers, played a pivotal role in this ecosystem. These companies provided components and offered integrated solutions that combined hardware, software, and services. For instance, companies like Bosch and Continental became leaders in automotive electronics, offering complete systems that included everything from sensors to control units. These integrators were essential in helping automakers manage the increasing complexity of modern vehicles.

Globalization and the Expansion of the Supply Chain

The latter half of the 20th century was marked by the rapid globalization of the automotive industry, which had profound implications for the partner ecosystem. As automakers sought to optimize costs and tap into new markets, they began to source parts and materials from a global network of suppliers.

One of the most significant developments during this period was the rise of just-in-time (JIT) manufacturing practices. Pioneered by Toyota in Japan, JIT aimed to reduce inventory costs by receiving parts only when they were needed for production. This approach required a highly coordinated and responsive supply chain, where suppliers had to deliver components precisely to keep production lines running smoothly. JIT became a cornerstone of lean manufacturing and was adopted by automakers around the world.

However, the globalization of the supply chain also introduced new challenges. Suppliers were often located in different countries, which increased the complexity of logistics and supply chain management. Additionally, geopolitical factors, trade policies, and currency fluctuations could impact the flow of parts and materials, making the supply chain more vulnerable to disruptions.

Despite these challenges, globalization allowed automakers to benefit from lower labor costs and access to specialized expertise in different regions. For example, many automotive electronics components were sourced from suppliers in Asia, where manufacturing costs were lower, and the expertise in semiconductors and electronics was more advanced.

The Impact of Economic Crises on the Partner Ecosystem

The automotive partner ecosystem has been shaped by various economic crises over the past few decades, each of which has tested the resilience and adaptability of the supply chain. The oil crises of the 1970s were among the first significant shocks to the system, as soaring fuel prices led to a dramatic shift in consumer preferences.

In response to the oil crises, governments worldwide introduced stringent fuel economy and emissions regulations. Automakers had to quickly adapt to these new standards, which required changes in vehicle design and the development of more fuel-efficient technologies. This shift had a ripple effect throughout the supply chain, as Tier 1 and 2 suppliers had to develop new materials and components that met the new requirements.

The Asian Financial Crisis of the late 1990s and the Global Financial Crisis of 2008 were also pivotal moments for the automotive partner ecosystem. These crises exposed the vulnerabilities of global supply chains and led to a wave of consolidation within the industry. Many smaller suppliers were forced out of the market, while larger companies merged to achieve economies of scale and strengthen their positions in the market.

The Global Financial Crisis, in particular, profoundly impacted the automotive industry. Major automakers faced bankruptcy, and the demand for vehicles plummeted. In response, many companies restructured their operations, focusing on core competencies and divesting non-essential businesses. This restructuring often involved renegotiating contracts with suppliers and seeking more favorable terms to reduce costs.

These crises resulted in a more consolidated and resilient automotive partner ecosystem, with fewer but larger suppliers playing a dominant role. However, this also meant that the supply chain became more concentrated, with fewer companies controlling key components and systems.

The Role of Innovation and Technology in Shaping the Ecosystem

Innovation and technology have always been driving forces in the evolution of the automotive partner ecosystem. Technological advancements have continually reshaped the relationships between automakers and their suppliers, from the early days of the combustion engine to the introduction of electronics and software.

One of the most significant technological shifts in recent decades has been the rise of electronics and software in vehicles. As cars have become more connected and autonomous, the role of traditional mechanical components has diminished while the importance of software and electronics has grown. This shift has led to new types of partnerships within the ecosystem, with tech companies and software developers becoming key players.

Electric Vehicles (EVs) development represents another major technological shift transforming the automotive partner ecosystem. EVs have fewer moving parts than traditional ICE vehicles, simplifying the supply chain and requiring new components, such as batteries and electric motors. This shift has forced traditional suppliers to adapt or risk becoming obsolete while creating opportunities for new entrants to the market.

As we move into the future, the automotive partner ecosystem will continue to evolve in response to new technologies, consumer demands, and global economic forces. The next section of this article will explore how these factors transform the industry and the future of the automotive partner ecosystem.

Read the 2nd part on "The Evolution of the Automotive Partner Ecosystem".

Best Practices Guidebook

How to Start and Scale Partner Ecosystems Best Practices

How to Start and Scale Partner Ecosystems Best PracticesDownload Guide

The Evolution of PartnerOps: Past, Present & Future Best Practices

The Evolution of PartnerOps: Past, Present & Future Best PracticesDownload Guide

Mastering Channel Sales: Strategies, Best Practices, and Growth Tactics for 2025

Mastering Channel Sales: Strategies, Best Practices, and Growth Tactics for 2025Download Guide

Winning with Partner Advisory Councils: Best Practices for Partner Engagement & Growth

Winning with Partner Advisory Councils: Best Practices for Partner Engagement & GrowthDownload Guide

The Future of Partner Ecosystems Best Practices

The Future of Partner Ecosystems Best PracticesDownload Guide

The AI Revolution: How Technology and Talent are Shaping the Future

The AI Revolution: How Technology and Talent are Shaping the FutureDownload Guide

Top 105 Partner Management Metrics that Matter Best Practices

Top 105 Partner Management Metrics that Matter Best PracticesDownload Guide

Mastering PRM Integration Best Practices

Mastering PRM Integration Best PracticesDownload Guide

Building a Sales Partner Portal with Salesforce Best Practices

Building a Sales Partner Portal with Salesforce Best PracticesDownload Guide

Building and Managing Partner Ecosystems Best Practices

Building and Managing Partner Ecosystems Best PracticesDownload Guide

Mastering Co-Marketing and Co-Selling Best Practices

Mastering Co-Marketing and Co-Selling Best PracticesDownload Guide

Transforming Partner Ecosystems Best Practices

Transforming Partner Ecosystems Best PracticesDownload Guide

Mastering Partner Ecosystems Best Practices

Mastering Partner Ecosystems Best PracticesDownload Guide

Mastering Partner Onboarding Best Practices

Mastering Partner Onboarding Best PracticesDownload Guide

Partner Ecosystem Management Best Practices

Partner Ecosystem Management Best PracticesDownload Guide

B2B Marketing in the Age of Intelligence Best Practices

B2B Marketing in the Age of Intelligence Best PracticesDownload Guide

Multi-Partner Co-Selling Best Practices

Multi-Partner Co-Selling Best PracticesDownload Guide

A Guide to Enhance Channel Sales Efficiency

A Guide to Enhance Channel Sales EfficiencyDownload Guide