Best Practices Articles

The Partner Ecosystem in the Oil & Natural Gas Industry: Evolution, Present Dynamics, and Future Outlook

The oil and natural gas industry plays a pivotal role in the global economy, providing over 56% of the world’s energy supply, according to the International Energy Agency (IEA). This massive sector is supported by an intricate and evolving partner ecosystem of various organizations, including exploration and production (E&P) companies, service providers, technology partners, regulators, and logistics firms. Together, they ensure the smooth operation of the industry's value chain, from the upstream exploration of resources to the downstream distribution of finished products like gasoline and natural gas.

Today, the ecosystem is experiencing significant transformations driven by technological innovations, environmental concerns, and geopolitical shifts. The increasing push toward decarbonization and the demand for cleaner, more sustainable energy sources force traditional oil and gas industry players to re-evaluate their partnerships, operations, and long-term strategies. This article will examine the evolution of the partner ecosystem in the oil and natural gas industry, its current state, and the potential future trajectory. We'll explore the entire value chain, highlighting the inter-dependencies between upstream, midstream, and downstream partners and how these relationships shape the industry.

Context & History

Early Stages of the Oil and Gas Ecosystem

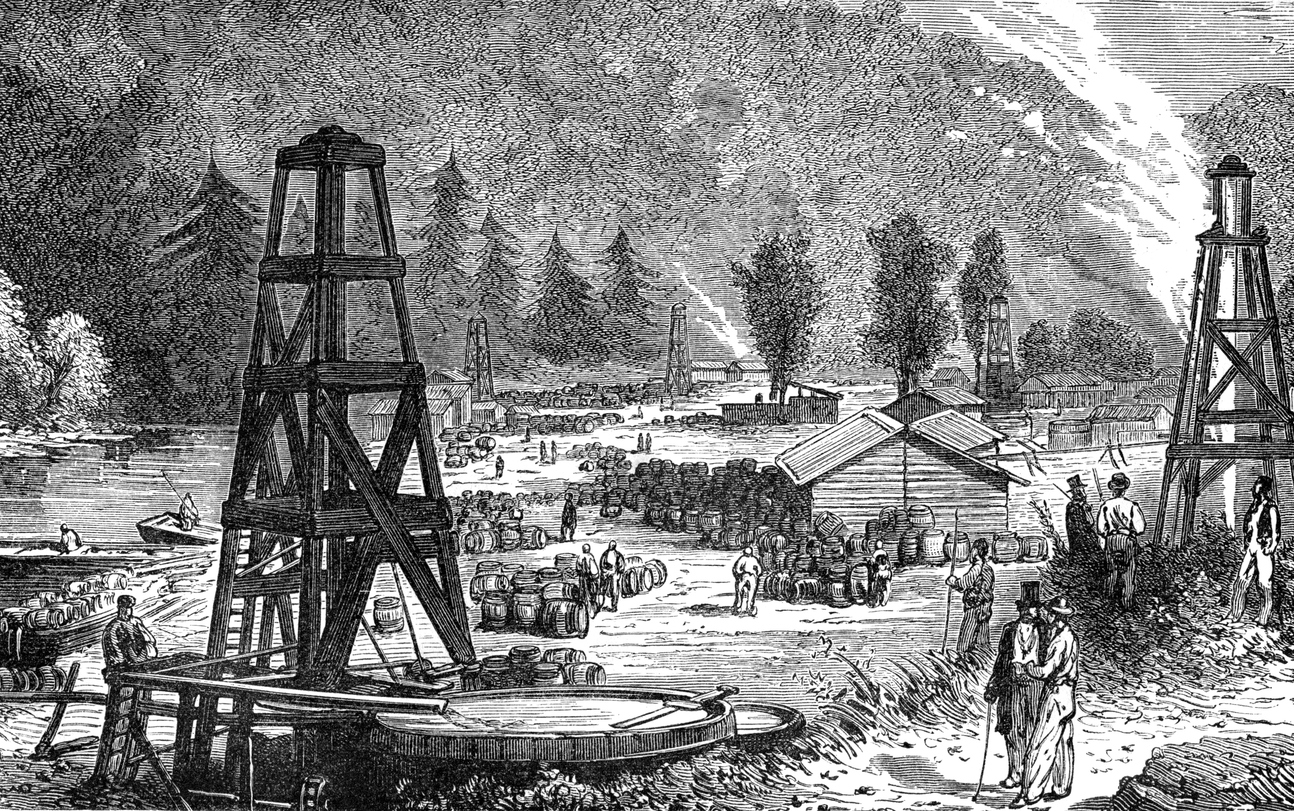

The discovery of oil in 1859 in Titusville, Pennsylvania, set the stage for what would become one of the most significant industries in modern history. Over the next few decades, oil and natural gas replaced coal as the dominant energy source, fueling industrial growth, transportation, and wars. By the early 20th century, oil's importance was so profound that it became a strategic resource for nations, contributing to the global geopolitical landscape we know today.

From the outset, the oil and gas ecosystem was inherently collaborative. Oil companies required specialized services and equipment to drill wells and refine crude oil into usable products. As a result, service companies such as Schulu (founded in 1926) and Halliburton (founded in 1919) became crucial partners in the exploration and production phases of the oil and gas value chain. Meanwhile, midstream and downstream companies were formed to transport, store, and refine crude oil, laying the groundwork for establishing an integrated value chain. By the 1950s, the global oil ecosystem had expanded to include multinational corporations like Exxon, BP, and Shell and national oil companies (NOCs) such as Saudi Aramco and Petrobras.

The Formation of OPEC and Market Control

The creation of the Organization of the Petroleum Exporting Countries (OPEC) in 1960 by five founding members—Saudi Arabia, Iran, Iraq, Kuwait, and Venezuela—marked a turning point in the ecosystem’s evolution. OPEC aimed to regulate oil production and stabilize prices by controlling output from member nations. Over time, OPEC’s influence grew as more countries joined, peaking in the 1970s with the oil embargo that quadrupled global oil prices. This significant geopolitical event underscored the interdependence between oil-producing and oil-consuming countries and the essential role of governments and international organizations in the ecosystem.

At the same time, the industry’s partner ecosystem expanded beyond traditional players like service providers and refineries. Partnerships with governments became more prominent, especially in countries with significant oil reserves, where exploration and extraction rights were negotiated through joint ventures. For example, Aramco—now the largest oil company in the world—began as a joint venture between the Saudi government and American oil companies.

Technological Milestones

In the late 20th and early 21st centuries, advancements in exploration and extraction technologies, such as hydraulic fracturing (fracking) and horizontal drilling, revolutionized the upstream segment. These technologies unlocked vast new oil and gas reserves, particularly in regions like the United States, where the shale revolution transformed the country into the world's largest oil producer by 2018.

The technological advancements of this period also extended to midstream and downstream operations. The rise of liquefied natural gas (LNG) as a major global commodity required significant investments in infrastructure and partnerships across the value chain. For example, companies like Cheniere Energy collaborated with engineering firms to build massive LNG export terminals along the Gulf Coast, which are responsible for exporting over 3.5 billion cubic feet per day (Bcf/d) of LNG to markets worldwide.

Current Situation

Upstream: Capital Intensity and Environmental Pressures

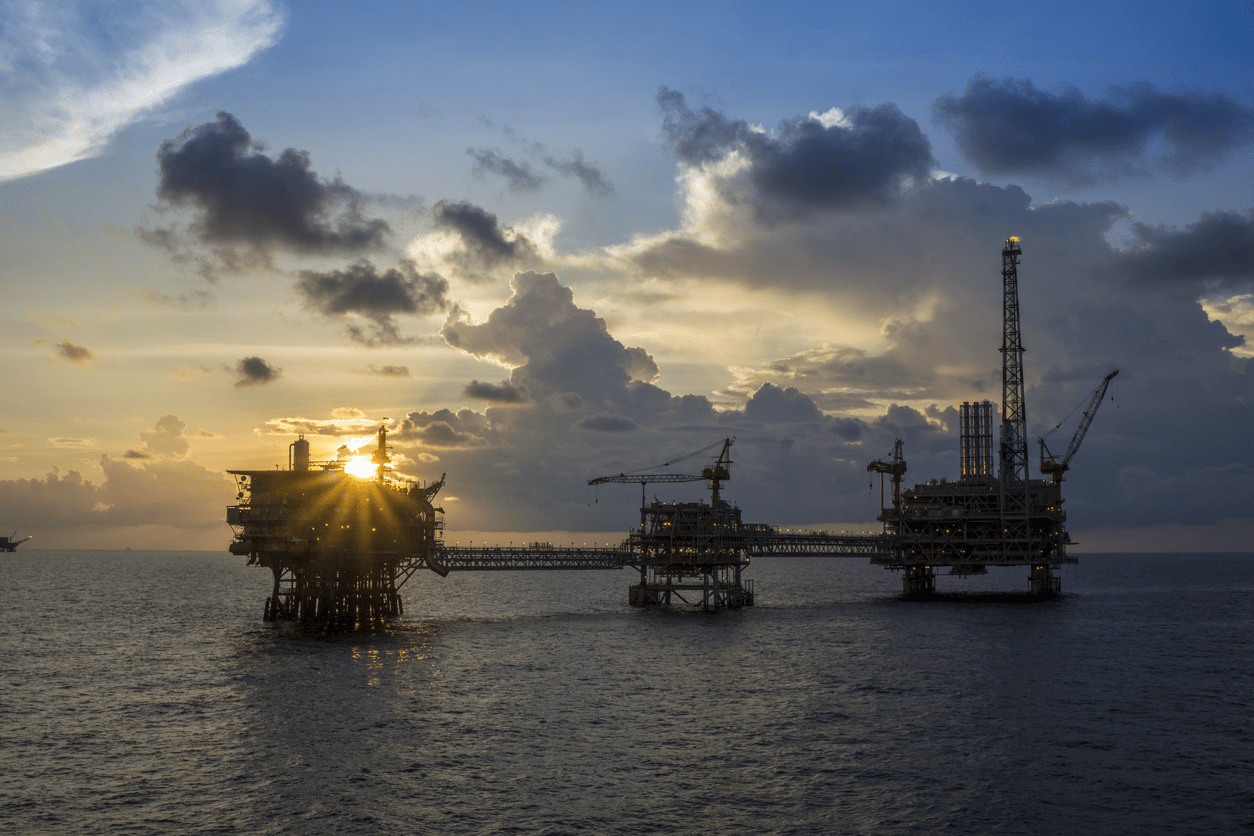

The upstream segment remains the most capital-intensive phase of the oil and gas value chain, requiring billions of dollars in investments in exploration and production. Today, the exploration and production (E&P) ecosystem is a complex web of partnerships that include international oil companies (IOCs), national oil companies (NOCs), independent producers, and service providers like Baker Hughes and Weatherford.

According to a report by Deloitte, capital expenditures (CapEx) in the upstream sector have surged in recent years, with global upstream investments expected to reach $370 billion in 2024. These investments are essential for tapping into new oil reserves, especially in deepwater and offshore fields requiring cutting-edge drilling technologies. At the same time, the increasing focus on sustainability has led to the development of partnerships aimed at reducing the environmental impact of exploration activities.

For instance, oil companies increasingly adopt carbon capture and storage (CCS) technologies to mitigate their operations' carbon footprint. One of the world’s largest oil companies, ExxonMobil, has invested heavily in CCS projects, partnering with research institutions and technology providers to develop solutions for capturing and storing carbon emissions.

Midstream: Infrastructure and Digitalization

The midstream segment transports oil and natural gas from production sites to refineries and export terminals, and it has traditionally relied on large-scale infrastructure investments. Pipeline operators like Enbridge and TransCanada form a crucial part of this ecosystem, facilitating the transportation of crude oil and natural gas across vast distances. The U.S. Energy Information Administration (EIA) reports that the United States alone has over 3 million miles of pipeline infrastructure, moving over 20 million barrels of crude oil and petroleum products daily.

However, midstream companies face increasing regulatory pressures related to environmental concerns. Leaks and spills from pipelines can cause significant environmental damage, leading to new regulations that demand higher safety and environmental standards. As a result, many midstream operators are adopting digital solutions, including real-time monitoring systems and predictive analytics, to detect potential leaks and optimize the flow of resources.

Companies like Kinder Morgan have partnered with technology firms to implement Internet of Things (IoT) sensors and AI-powered analytics, which continuously monitor pipeline conditions and help prevent accidents. These technologies not only improve operational efficiency but also help reduce environmental risks, aligning with broader industry goals of sustainability.

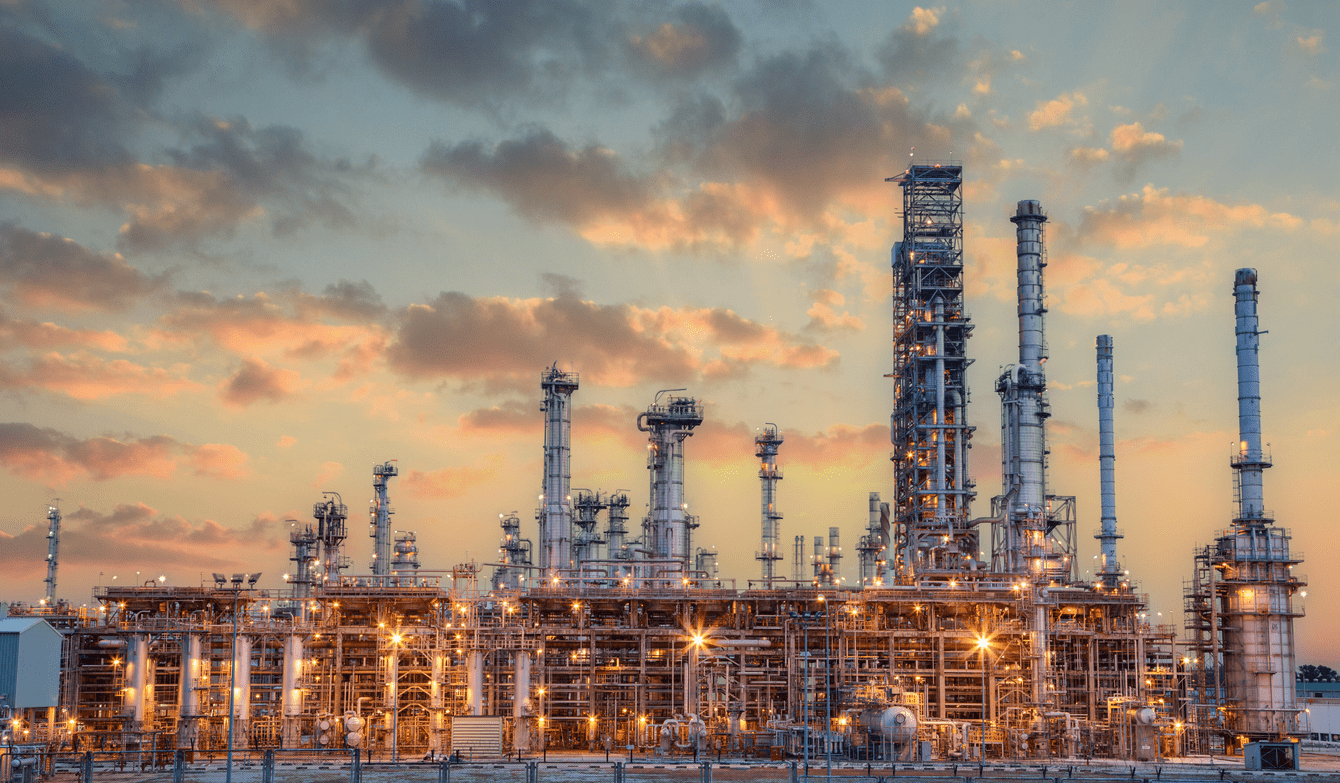

Downstream: Refining and Changing Consumer Preferences

The downstream segment, responsible for refining crude oil into products like gasoline, diesel, and petrochemicals, is experiencing significant shifts due to changes in consumer behavior and stricter environmental regulations. According to a McKinsey report, global refining capacity is expected to decrease by 1 million barrels per day (bpd) by 2030, driven by declining demand for traditional fuels like gasoline.

Consumers increasingly shift toward electric vehicles (EVs) and cleaner energy sources, profoundly impacting the downstream partner ecosystem. Oil companies are responding by diversifying their offerings to include renewable energy and electric vehicle (EV) charging solutions. For example, Shell has partnered with Greenlots, a leader in EV charging solutions, to roll out EV charging stations across its global network of retail gas stations.

Additionally, refiners are exploring partnerships in biofuels, hydrogen, and synthetic fuels to align with evolving market demands. BP has invested in Fulcrum BioEnergy, which converts municipal waste into jet fuel, demonstrating the industry’s push toward more sustainable solutions.

Future State

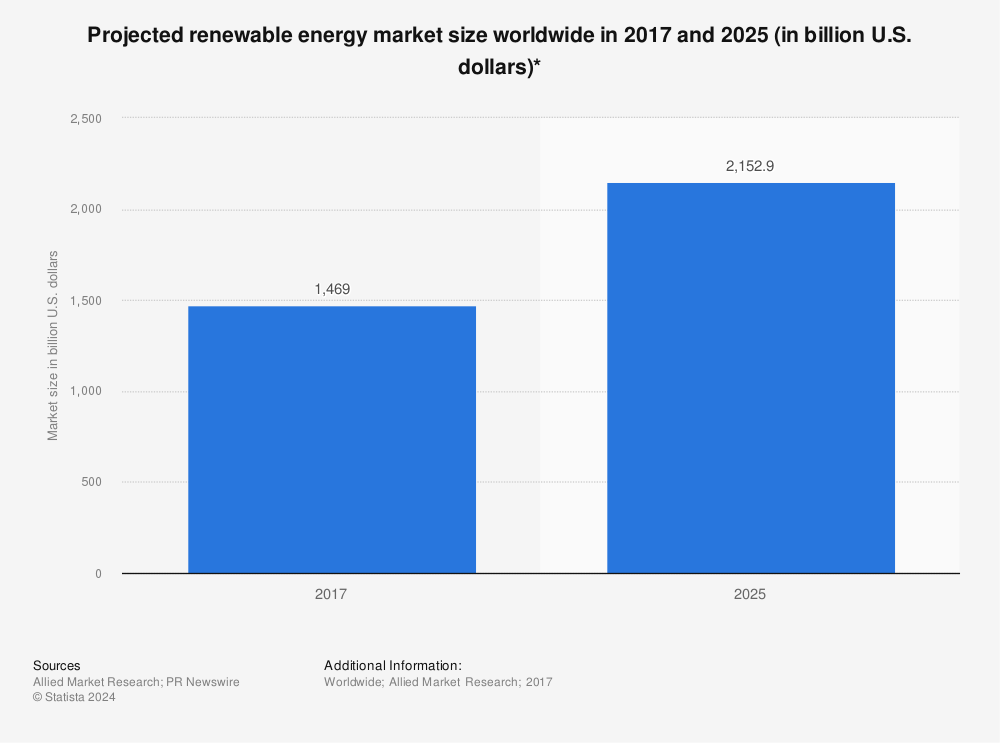

Decarbonization and the Rise of Renewable Energy

The global push for decarbonization is driving significant changes across the oil and natural gas ecosystem. According to Statista, global investments in renewable energy are projected to reach $1.3 trillion annually by 2025, outpacing investments in traditional fossil fuels. This shift toward cleaner energy sources will force oil companies to diversify their portfolios and invest heavily in renewables like solar, wind, and hydrogen.

The transition is already underway, with major oil companies like TotalEnergies and Equinor rebranding themselves as integrated energy companies, committed to reducing their carbon emissions and investing in clean energy technologies. Partnerships between oil majors, renewable energy firms, and technology companies will facilitate this transition. For example, Equinor has entered into a strategic alliance with Siemens Gamesa to develop offshore wind farms, underscoring the importance of collaboration in the new energy landscape.

Technological Innovation and AI Integration

The widespread adoption of artificial intelligence (AI), machine learning, and big data analytics will shape the future of the oil and gas ecosystem. These technologies are already being integrated across the value chain to optimize operations, reduce costs, and improve decision-making. Chevron, for example, has partnered with Microsoft to use AI and machine learning in its upstream operations to enhance exploration accuracy and optimize drilling processes.

Moreover, implementing digital twins, virtual replicas of physical assets, will become more common in midstream and downstream operations. Digital twins enable real-time monitoring and predictive equipment maintenance, reducing downtime and preventing costly repairs. According to Gartner, the adoption of digital twins is expected to grow by 38% annually in the oil and gas sector, highlighting its significance in the future.

Circular Economies and Waste Reduction

Another critical trend shaping the future of the oil and gas industry is the move toward circular economies, where waste products are recycled and reused, reducing environmental impact. The petrochemical industry, a significant part of the downstream segment, is exploring partnerships to turn plastic waste into petrochemical feedstock. For instance, Shell has partnered with Plastic Energy, a UK-based company specializing in plastic recycling, to develop a plant that converts plastic waste into chemicals used in refining and manufacturing.

These initiatives reflect the growing importance of sustainability in the oil and gas ecosystem. As public and regulatory pressure intensifies, oil companies must innovate and collaborate to minimize their environmental footprint and ensure long-term viability.

Conclusion

The oil and natural gas industry is transforming profoundly, driven by the dual forces of technological innovation and the global shift toward sustainability. The industry’s partner ecosystem, which has always been integral to its operations, is evolving to meet the challenges and opportunities presented by these trends. From upstream exploration companies collaborating with AI firms to optimize resource extraction to downstream players partnering with renewable energy providers to diversify their portfolios, the industry's future lies in its ability to innovate through strategic partnerships.

The oil and gas ecosystem will continue diversifying, incorporating various stakeholders, including renewable energy companies, technology firms, and environmental organizations. Industry players' ability to adapt and thrive in this new environment will depend on their willingness to embrace collaboration, sustainability, and technological innovation across the entire value chain.

In the coming decades, the oil and gas sector must respond to immediate market demands and prepare for a future where clean energy, digital transformation, and circular economies are central to its operations. Those who successfully navigate this shift will remain relevant in a rapidly changing energy landscape.

Best Practices Guidebook

Winning with Partner Advisory Councils: Best Practices for Partner Engagement & Growth

Winning with Partner Advisory Councils: Best Practices for Partner Engagement & GrowthDownload Guide

The Future of Partner Ecosystems Best Practices

The Future of Partner Ecosystems Best PracticesDownload Guide

The AI Revolution: How Technology and Talent are Shaping the Future

The AI Revolution: How Technology and Talent are Shaping the FutureDownload Guide

Top 105 Partner Management Metrics that Matter Best Practices

Top 105 Partner Management Metrics that Matter Best PracticesDownload Guide

Mastering PRM Integration Best Practices

Mastering PRM Integration Best PracticesDownload Guide

Building a Sales Partner Portal with Salesforce Best Practices

Building a Sales Partner Portal with Salesforce Best PracticesDownload Guide

Building and Managing Partner Ecosystems Best Practices

Building and Managing Partner Ecosystems Best PracticesDownload Guide

Mastering Co-Marketing and Co-Selling Best Practices

Mastering Co-Marketing and Co-Selling Best PracticesDownload Guide

Transforming Partner Ecosystems Best Practices

Transforming Partner Ecosystems Best PracticesDownload Guide

Mastering Partner Ecosystems Best Practices

Mastering Partner Ecosystems Best PracticesDownload Guide

Mastering Partner Onboarding Best Practices

Mastering Partner Onboarding Best PracticesDownload Guide

Partner Ecosystem Management Best Practices

Partner Ecosystem Management Best PracticesDownload Guide

B2B Marketing in the Age of Intelligence Best Practices

B2B Marketing in the Age of Intelligence Best PracticesDownload Guide

Multi-Partner Co-Selling Best Practices

Multi-Partner Co-Selling Best PracticesDownload Guide

A Guide to Enhance Channel Sales Efficiency

A Guide to Enhance Channel Sales EfficiencyDownload Guide

Mastering Affiliate Marketing Best Practices

Mastering Affiliate Marketing Best PracticesDownload Guide

The Ultimate Guide to Channel Partner Management

The Ultimate Guide to Channel Partner ManagementDownload Guide

Top 10 Trends in 2024 Partner Relationship Management

Top 10 Trends in 2024 Partner Relationship ManagementDownload Guide